Perpetual DEX Volumes Surge Nearly Threefold in 2025 as On-Chain Derivatives Gain Maturity

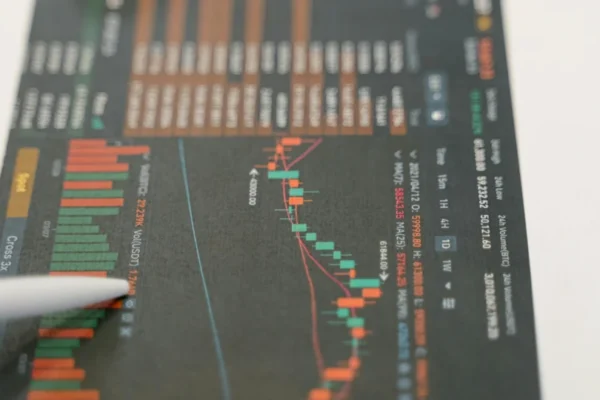

DeFi Derivatives Market Expansion in 2025 The decentralized finance (DeFi) sector experienced significant growth in 2025, particularly in perpetual futures trading on decentralized exchanges (DEXs). This surge reflects the broader maturation of on-chain derivatives, where trading volumes for perpetual contracts—financial instruments that allow indefinite exposure to asset prices without expiration—nearly tripled compared to the previous…